Get paid into your UK bank account: showing proof of employment and steady income will help establish credit in the UK.įor more information on how to build credit in the UK check out these resources:.Start building credit using debt, apps and more: credit builder apps can help you build credit quickly if you are new to the UK.It’s important to note that this option is only available for people moving to the UK from Commonwealth countries such as Australia or Canada. Register to Vote: getting on the electoral roll is an easy way to increase your credit score.Citibank and HSBC are international banks that typically allow for this. Consider looking into if you’re able to open a UK bank account ahead of time in your home country. Open a Current Account at a Bank or Credit Union: This may be a bit of a challenge since you need a permanent address to open a bank account.Get a UK Address: you will need a permanent address in the UK to register and begin building credit.It’s clear that having credit history is important to gaining financial freedom in the UK, which leaves us asking the question: where do we start? The good news is that it’s fairly easy to get started on the first few steps! What are the First Steps to Building Credit in the UK? It can be a slow process, but if you manage things correctly, you can and will succeed. But no need to worry if you just moved here from overseas and need to get started. The point is, having credit history in the UK is important. Some employers may even ask to run a credit check on you before offering you employment, however they need your permission to do this. Having good credit history is important if you want to get approved for: It’s also worth noting that banks aren't required to lend to anyone they deem risky. Having a credit score is useful because banks and lenders typically like to lend money to people who are likely to repay. Why is Credit Important in the UK?Ĭredit scores are an important measure of financial health in the UK. It’s safe to assume that amongst the 67 million people in the UK, the average credit score typically falls in the fair range amongst all three credit rating agencies.

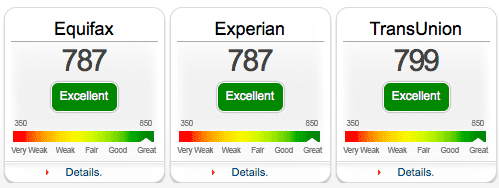

The average score among all of its customers is 759 out of 999 which also falls in the ‘fair’ range. To read more about why and how your Equifax score has changed click here.Įxperian: publishes average credit score data based on location and age group via their interactive credit map.

0 kommentar(er)

0 kommentar(er)